Quick Overview:

Online rental pricing tools often miss local nuances critical in Chicago.

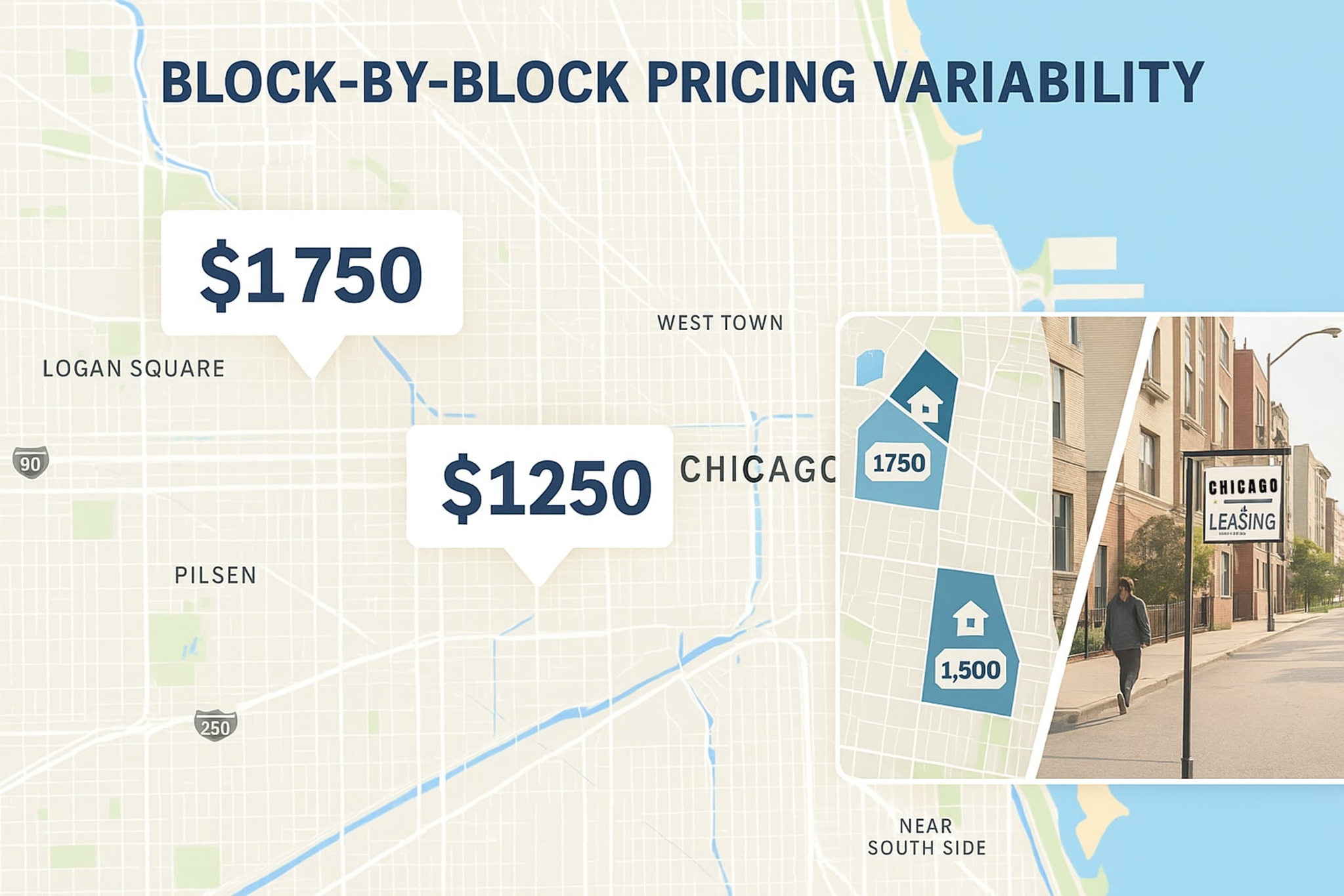

Block-by-block variability makes automated estimates unreliable.

Zillow and Redfin use lagging data and lack insight into current tenant demand.

Chicago's rental pricing is being reshaped by legislation, development, and shifting tenant expectations.

Accurate pricing requires expert, hyper-local knowledge — not national algorithms.

Introduction to Chicago Rental Market

The Chicago rental market is a complex and dynamic sector, influenced by many factors such as market trends, seasonal fluctuations, and urban living preferences. For real estate professionals, landlords, and buyers, understanding these elements is crucial to making informed decisions. The market is characterized by a wide range of property types, including apartments, condos, and single-family homes, catering to diverse buyer and renter needs.

Chicago’s rental market is also shaped by the 77 officially designated community areas and over 200 neighborhoods, each with its own distinct character, amenities, and price points. From the busy streets of the Loop to the charming areas of Lincoln Square, every neighborhood offers something different! Keep in mind that the dynamics of each neighborhood, such as the transportation developments, are constantly changing and it is important to stay up to date with how these changes affect demand and value when it comes to rental units.

The Truth Behind Zillow and Redfin Rental Estimates in Chicago

Zillow and Redfin are household names in the real estate world, but when it comes to Zillow rental estimate accuracy in Chicago, they often miss the mark. Although they can be a good place to start, their tools rely heavily on publicly available data, historical comps, and neighborhood averages — but in a city as hyper-local as Chicago, that approach doesn’t hold up. Accurate data related to the home and its address is crucial for precise estimates, and any discrepancies can lead to significant errors.

For example, a two-bedroom apartment in Logan Square with outdated finishes and no parking may get a similar algorithmic estimate as a renovated unit in the same zip code with stainless steel appliances and in-unit laundry. To a landlord relying on these platforms, this could mean pricing your unit too high — resulting in weeks of vacancy — or too low, leaving money on the table.

Yes, Zillow utilizes data from hundreds of multiple listing services and brokerages to develop accurate home valuations through advanced statistical and machine learning models. However, even with this data, the hyper-local nature of Chicago's real estate market can still pose challenges. In neighborhoods like Avondale, Pilsen, or Bridgeport, pricing can change significantly block by block, based on school zones, transit access, or even which side of the street the property sits on!

Why Chicago Rental Pricing Requires a Local Touch

Many rental pricing tools in Chicago fail because they don’t account for seasonal demand shifts, inventory levels, or real-time changes like construction, crime trends, or public transportation updates. The availability of data significantly influences pricing strategies, ensuring accurate real estate valuations.

For example, in Lakeview, proximity to the CTA Red Line can increase rent potential by 10–15%. In Bronzeville, ongoing redevelopment projects are pushing rental values higher each quarter. Yet these insights rarely show up in automated rent calculators.

As a local property management company, we’ve seen firsthand how nuanced Chicago’s market is. We evaluate factors like:

Tenant demand in the immediate area.

Recent nearby lease comps, not just sales data.

School boundaries and local zoning ordinances.

Unit condition and curb appeal.

Proximity to new restaurants, developments, or infrastructure upgrades.

Daily feedback from our leasing agents that are on the front line experiencing the market shifts in real time.

This kind of pricing strategy can’t be replicated by an algorithm.

Top Real Estate Pricing Myths Chicago Landlords Still Believe

Many investors enter the market thinking the “Zestimate” or Redfin Estimate is a reliable benchmark. However, understanding market trends is crucial for business strategies in real estate. Here are a few real estate pricing myths Chicago landlords should let go of:

Myth: You can always raise rent annually. In some areas, pushing rent too aggressively leads to turnover, which can be more expensive than a modest increase.

Myth: Your rent should match others in your building. Not necessarily. Corner units, top floors, or recent upgrades can justify different pricing — even within the same building.

Myth: New construction nearby always raises value. In some cases, new competition drives prices down if inventory floods the area.

Myth: Market rent is what the last tenant paid.The rental market shifts constantly. Rents from even 12 months ago may be outdated.

These myths are especially costly in tight or evolving submarkets like Albany Park, West Loop, or Humboldt Park. Overlooking these insights can lead to significant financial losses, emphasizing the importance of proper inspections and knowledge to avoid common myths that could financially impact someone looking to buy or sell.

Real Estate Opportunities

With its wide range of neighborhoods and property types, Chicago presents diverse opportunities for rental investors — from value-add multifamily deals in emerging areas to high-demand rentals near transit hubs.

Local property management companies like Landmark help investors identify and act on these opportunities by staying ahead of zoning changes, demand trends, and market shifts. Whether you're looking to expand your portfolio, reposition a property, or optimize cash flow, expert local insight can make all the difference.

What the 2025 Chicago Rental Market Forecast Tells Us

Chicago’s 2025 rental market is looking up — but there’s more to the story.

Vacancy Rates are Tightening

Vacancy rates are tightening in high-demand neighborhoods like Logan Square, Lincoln Park, and Andersonville, driven in part by a slowdown in new multifamily construction. Rising interest rates are also keeping many would-be buyers in rentals longer, further fueling demand.

At the same time, specific regions across the Midwest—Chicago included—are becoming more attractive to investors due to their relative affordability compared to coastal markets. Favorable cap rates, steady renter demand, and investor interest all signal strong momentum for Chicago’s rental housing sector.

Rent Control Debates and Legislative Pressure

Legislation is back in the spotlight as rent control debates resurface in Illinois. While statewide rent control is still prohibited under the 1997 Rent Control Preemption Act, local advocacy groups continue to push for change.

In Chicago, pressure is particularly strong around The 606 Trail, where long-time residents face rising rents and displacement. In response, the city passed the Anti-Gentrification Ordinance, imposing strict regulations on property sales and redevelopment in neighborhoods like Logan Square and Humboldt Park.

These legal changes mark a significant shift in market dynamics compared to just a year ago, especially in gentrifying areas.

Renter Migration to Outer-Ring Suburbs

Affordability concerns are pushing more renters toward outer-ring suburbs such as Naperville, Orland Park, and New Lenox. These areas offer larger units, more parking, and better value for budget-conscious tenants.

Additionally, remote and hybrid work models continue to influence renter behavior. More households are seeking extra space for home offices, increasing demand in neighborhoods and suburbs where larger floorplans are easier to find.

Institutional Investment and Mid-Tier Market Focus

Institutional investors are returning to Chicago’s rental market—but with a shift in focus. Many are targeting Class B and C multifamily properties due to their resilience, strong cash flow, and appeal to renters priced out of higher-end units.

These mid-tier properties present a more stable investment opportunity, especially as luxury units in some Class A buildings have started to plateau in rent growth.

Margin Pressure from Taxes and Insurance

Despite promising rent trends, investors and landlords are feeling the squeeze from rising property taxes and insurance premiums, particularly in Cook County. These costs are cutting into margins and influencing long-term investment strategies.

For many owners, balancing rent increases with affordability and compliance remains a growing challenge—adding yet another layer to Chicago’s evolving rental landscape.

Landlords must stay agile — pricing units based on current data, not national estimates or last year’s rent roll.

How to Accurately Price Your Rental Property (And Get It Rented Faster)

At Landmark Property Management, we don’t guess. We price with precision — combining data, market knowledge, and real-time feedback from showings. Our leasing team tracks live activity across Chicago and its suburbs, allowing us to tweak prices before a unit sits too long. By shifting our attention to strategic decisions, we ensure that our pricing strategies are always proactive and effective.

We also offer:

Custom FREE market analyses for your property (Yes, completely FREE of charge even if you don't use our services!)

Professional marketing that targets ideal tenants

Strategic timing based on seasonal trends and lease expirations, including the best times to list your property

There are various ways to navigate Chicago's real estate market, and understanding the right way to make informed decisions is crucial. Don’t leave your investment in the hands of a national algorithm. Trust a local expert who knows your block, your building, and your goals.

Learn more about our Pricing & Leasing Services and Request your Free Rental Analysis

.png)